Keenen's first day of four year old preschool at Angels of Hope Preschool.

Enoch's first day of first grade at Green Bay Trinity.

Isen's first day of third grade at Green Bay Trinity.

Keenen's first day of four year old preschool at Angels of Hope Preschool.

Enoch's first day of first grade at Green Bay Trinity.

Isen's first day of third grade at Green Bay Trinity.

I seem to go in spurts with this blog...one week I do really well and then three weeks (okay a few months) later I realize that I miss writing or posting silly things here and I start up again. Well, here I am trying *again* at this blog.

Things are still where they were when we left off. Life, all in all, is good. Church life, all in all, really bites. Adoption, on hold until God lets us in on His plan.

Today will be a relaxing day, hanging out with the family watching the game (no, not the Packers). The game in our household is the Lions. Go Detroit! (Can you all hear my enthusiasm)?

This picture is from the beginning of August when it was so hot you couldn't do anything but sit in the pool.

Today the buses where running past our bedroom window at 7:30am. Not cool! So, very, not cool!

Today the buses where running past our bedroom window at 7:30am. Not cool! So, very, not cool!

It was a very rude reminder that school starts on Wednesday. I have so much to do before then. I have to finish getting the boys school bags packed and ready. I have to find all the lunch bags, I have art lessons to finish, I have to clean the preschool (my second job), I really, really have to get caught up on laundry (and I mean really have to...it is a disaster area down there), then there is the never ending task of pre-packing for a move that will hopefully happen soon, and on top of it all, I have to pack for our end of summer vacation. Clearly my husband and I were not thinking the logistics through when we planned this vacation last spring. It is like my sister-in-law said, "the amount of extra work required to be able to take a vacation seems counterproductive, somehow."

My list is a good foot long. There are the tents, sleeping bags, pillows, food, cooking equipment, bikes, the dog and all the stuff she requires, swimsuits and the list just seems to go on and on. Then comes the tricky part that we didn't think through (yes, that is a theme to all our vacations) how do we get all this stuff in our van and still leave room for the kids? We don't have a bike rack, trailer, much less a hitch to attach them to. Plus we have a black lab. Her stuff alone takes up half the van. Luckily, my step-dad is uber-awesome and is letting us take his pick-up truck on our trip.

Thank God for wonderful family! Now back to packing....wish me luck.

HT: NYT & Mark Bittman

WHAT will it take to get Americans to change our eating habits? The need is indisputable, since heart disease, diabetes and cancer are all in large part caused by the Standard American Diet. (Yes, it’s SAD.)

Though experts increasingly recommend a diet high in plants and low in animal products and processed foods, ours is quite the opposite, and there’s little disagreement that changing it could improve our health and save tens of millions of lives.

And — not inconsequential during the current struggle over deficits and spending — a sane diet could save tens if not hundreds of billions of dollars in health care costs.

Yet the food industry appears incapable of marketing healthier foods. And whether its leaders are confused or just stalling doesn’t matter, because the fixes are not really their problem. Their mission is not public health but profit, so they’ll continue to sell the health-damaging food that’s most profitable, until the market or another force skews things otherwise. That “other force” should be the federal government, fulfilling its role as an agent of the public good and establishing a bold national fix.

Rather than subsidizing the production of unhealthful foods, we should turn the tables and tax things like soda, French fries, doughnuts and hyperprocessed snacks. The resulting income should be earmarked for a program that encourages a sound diet for Americans by making healthy food more affordable and widely available.

The average American consumes 44.7 gallons of soft drinks annually. (Although that includes diet sodas, it does not include noncarbonated sweetened beverages, which add up to at least 17 gallons a person per year.) Sweetened drinks could be taxed at 2 cents per ounce, so a six-pack of Pepsi would cost $1.44 more than it does now. An equivalent tax on fries might be 50 cents per serving; a quarter extra for a doughnut. (We have experts who can figure out how “bad” a food should be to qualify, and what the rate should be; right now they’re busy calculating ethanol subsidies. Diet sodas would not be taxed.)

The average American consumes 44.7 gallons of soft drinks annually. (Although that includes diet sodas, it does not include noncarbonated sweetened beverages, which add up to at least 17 gallons a person per year.) Sweetened drinks could be taxed at 2 cents per ounce, so a six-pack of Pepsi would cost $1.44 more than it does now. An equivalent tax on fries might be 50 cents per serving; a quarter extra for a doughnut. (We have experts who can figure out how “bad” a food should be to qualify, and what the rate should be; right now they’re busy calculating ethanol subsidies. Diet sodas would not be taxed.)

Simply put: taxes would reduce consumption of unhealthful foods and generate billions of dollars annually. That money could be used to subsidize the purchase of staple foods like seasonal greens, vegetables, whole grains, dried legumes and fruit.

We could sell those staples cheap — let’s say for 50 cents a pound — and almost everywhere: drugstores, street corners, convenience stores, bodegas, supermarkets, liquor stores, even schools, libraries and other community centers.

This program would, of course, upset the processed food industry. Oh well. It would also bug those who might resent paying more for soda and chips and argue that their right to eat whatever they wanted was being breached. But public health is the role of the government, and our diet is right up there with any other public responsibility you can name, from water treatment to mass transit.

Some advocates for the poor say taxes like these are unfair because low-income people pay a higher percentage of their income for food and would find it more difficult to buy soda or junk. But since poor people suffer disproportionately from the cost of high-quality, fresh foods, subsidizing those foods would be particularly beneficial to them.

Right now it’s harder for many people to buy fruit than Froot Loops; chips and Coke are a common breakfast. And since the rate of diabetes continues to soar — one-third of all Americans either have diabetes or are pre-diabetic, most with Type 2 diabetes, the kind associated with bad eating habits — and because our health care bills are on the verge of becoming truly insurmountable, this is urgent for economic sanity as well as national health.

Justifying a Tax

At least 30 cities and states have considered taxes on soda or all sugar-sweetened beverages, and they’re a logical target: of the 278 additional calories Americans on average consumed per day between 1977 and 2001, more than 40 percent came from soda, “fruit” drinks, mixes like Kool-Aid and Crystal Light, and beverages like Red Bull, Gatorade and dubious offerings like Vitamin Water, which contains half as much sugar as Coke.

At least 30 cities and states have considered taxes on soda or all sugar-sweetened beverages, and they’re a logical target: of the 278 additional calories Americans on average consumed per day between 1977 and 2001, more than 40 percent came from soda, “fruit” drinks, mixes like Kool-Aid and Crystal Light, and beverages like Red Bull, Gatorade and dubious offerings like Vitamin Water, which contains half as much sugar as Coke.

Some states already have taxes on soda — mostly low, ineffective sales taxes paid at the register. The current talk is of excise taxes, levied before purchase.

“Excise taxes have the benefit of being incorporated into the shelf price, and that’s where consumers make their purchasing decisions,” says Lisa Powell, a senior research scientist at the Institute for Health Research and Policy at the University of Illinois at Chicago. “And, as per-unit taxes, they avoid volume discounts and are ultimately more effective in raising prices, so they have greater impact.”

Much of the research on beverage taxes comes from the Rudd Center for Food Policy and Obesity at Yale. Its projections indicate that taxes become significant at the equivalent of about a penny an ounce, a level at which three very good things should begin to happen: the consumption of sugar-sweetened beverages should decrease, as should the incidence of disease and therefore public health costs; and money could be raised for other uses.

Even in the current antitax climate, we’ll probably see new, significant soda taxes soon, somewhere; Philadelphia, New York (city and state) and San Francisco all considered them last year, and the scenario for such a tax spreading could be similar to that of legalized gambling: once the income stream becomes apparent, it will seem irresistible to cash-strapped governments.

Currently, instead of taxing sodas and other unhealthful food, we subsidize them (with, I might note, tax dollars!). Direct subsidies to farmers for crops like corn (used, for example, to make now-ubiquitous high-fructose corn syrup) and soybeans (vegetable oil) keep the prices of many unhealthful foods and beverages artificially low. There are indirect subsidies as well, because prices of junk foods don’t reflect the costs of repairing our health and the environment.

Other countries are considering or have already started programs to tax foods with negative effects on health. Denmark’s saturated-fat tax is going into effect Oct. 1, and Romania passed (and then un-passed) something similar; earlier this month, a French minister raised the idea of tripling the value added tax on soda. Meanwhile, Hungary is proposing a new tax on foods with “too much” sugar, salt or fat, while increasing taxes on liquor and soft drinks, all to pay for state-financed health care; and Brazil’s Fome Zero (Zero Hunger) program features subsidized produce markets and state-sponsored low-cost restaurants.

Putting all of those elements together could create a national program that would make progress on a half-dozen problems at once — disease, budget, health care, environment, food access and more — while paying for itself. The benefits are staggering, and though it would take a level of political will that’s rarely seen, it’s hardly a moonshot.

The need is dire: efforts to shift the national diet have failed, because education alone is no match for marketing dollars that push the very foods that are the worst for us. (The fast-food industry alone spent more than $4 billion on marketing in 2009; the Department of Agriculture’s Center for Nutrition Policy and Promotion is asking for about a third of a percent of that in 2012: $13 million.) As a result, the percentage of obese adults has more than doubled over the last 30 years; the percentage of obese children has tripled. We eat nearly 10 percent more animal products than we did a generation or two ago, and though there may be value in eating at least some animal products, we could perhaps live with reduced consumption of triple bacon cheeseburgers.

Government and Public Health

Health-related obesity costs are projected to reach $344 billion by 2018 — with roughly 60 percent of that cost borne by the federal government. For a precedent in attacking this problem, look at the action government took in the case of tobacco.

The historic 1998 tobacco settlement, in which the states settled health-related lawsuits against tobacco companies, and the companies agreed to curtail marketing and finance antismoking efforts, was far from perfect, but consider the results. More than half of all Americans who once smoked have quit and smoking rates are about half of what they were in the 1960s.

It’s true that you don’t need to smoke and you do need to eat. But you don’t need sugary beverages (or the associated fries), which have been linked not only to Type 2 diabetes and increased obesity but also to cardiovascular diseases and decreased intake of valuable nutrients like calcium. It also appears that liquid calories provide less feeling of fullness; in other words, when you drink a soda it’s probably in addition to your other calorie intake, not instead of it.

To counter arguments about their nutritional worthlessness, expect to see “fortified” sodas — à la Red Bull, whose vitamins allegedly “support mental and physical performance” — and “improved” junk foods (Less Sugar! Higher Fiber!). Indeed, there may be reasons to make nutritionally worthless foods less so, but it’s better to decrease their consumption.

Forcing sales of junk food down through taxes isn’t ideal. First off, we’ll have to listen to nanny-state arguments, which can be countered by the acceptance of the anti-tobacco movement as well as a dozen other successful public health measures. Then there are the predictions of job loss at soda distributorships, but the same predictions were made about the tobacco industry, and those were wrong. (For that matter, the same predictions were made around the nickel deposit on bottles, which most shoppers don’t even notice.) Ultimately, however, both consumers and government will be more than reimbursed in the form of cheaper healthy staples, lowered health care costs and better health. And that’s a big deal.

The Resulting Benefits

A study by Y. Claire Wang, an assistant professor at Columbia’s Mailman School of Public Health, predicted that a penny tax per ounce on sugar-sweetened beverages in New York State would save $3 billion in health care costs over the course of a decade, prevent something like 37,000 cases of diabetes and bring in $1 billion annually. Another study shows that a two-cent tax per ounce in Illinois would reduce obesity in youth by 18 percent, save nearly $350 million and bring in over $800 million taxes annually.

Scaled nationally, as it should be, the projected benefits are even more impressive; one study suggests that a national penny-per-ounce tax on sugar-sweetened beverages would generate at least $13 billion a year in income while cutting consumption by 24 percent. And those numbers would swell dramatically if the tax were extended to more kinds of junk or doubled to two cents an ounce. (The Rudd Center has a nifty revenue calculatoronline that lets you play with the numbers yourself.)

A 20 percent increase in the price of sugary drinks nationally could result in about a 20 percent decrease in consumption, which in the next decade could prevent 1.5 million Americans from becoming obese and 400,000 cases of diabetes, saving about $30 billion.

It’s fun — inspiring, even — to think about implementing a program like this. First off, though the reduced costs of healthy foods obviously benefit the poor most, lower prices across the board keep things simpler and all of us, especially children whose habits are just developing, could use help in eating differently. The program would also bring much needed encouragement to farmers, including subsidies, if necessary, to grow staples instead of commodity crops.

Other ideas: We could convert refrigerated soda machines to vending machines that dispense grapes and carrots, as has already been done in Japan and Iowa. We could provide recipes, cooking lessons, even cookware for those who can’t afford it. Television public-service announcements could promote healthier eating. (Currently, 86 percent of food ads now seen by children are for foods high in sugar, fat or sodium.)

Money could be returned to communities for local spending on gyms, pools, jogging and bike trails; and for other activities at food distribution centers; for Meals on Wheels in those towns with a large elderly population, or for Head Start for those with more children; for supermarkets and farmers’ markets where needed. And more.

By profiting as a society from the foods that are making us sick and using those funds to make us healthy, the United States would gain the same kind of prestige that we did by attacking smoking. We could institute a national, comprehensive program that would make us a world leader in preventing chronic or “lifestyle” diseases, which for the first time in history kill more people than communicable ones. By doing so, we’d not only repair some of the damage we have caused by first inventing and then exporting the Standard American Diet, we’d also set a new standard for the rest of the world to follow.

Rembrandt, The Three Crosses, etching, 1653, state III of V

Rembrandt, The Three Crosses, etching, 1653, state III of V

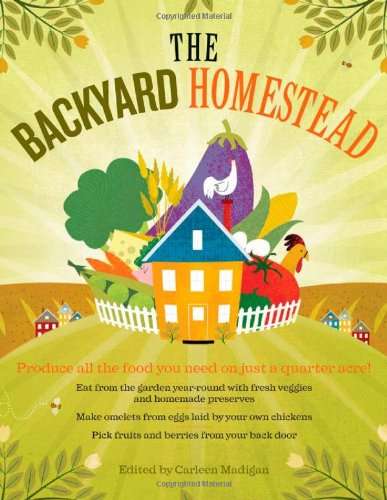

Picked this book up at the Green Bay Botanical Garden the other week. Read through it in five days and I am already making plans to make this a reality (complete with miniature goats...someday).

Picked this book up at the Green Bay Botanical Garden the other week. Read through it in five days and I am already making plans to make this a reality (complete with miniature goats...someday).

Yesterday our family headed for the Lake Michigan coastline to cool down (we've had "excessive heat warnings" for days now) and yesterday was no exception. We had planned on using a Groupon to go bowling but they are closed for maintenance until the end of the month (it was nice of them to put that on their Website so I knew that before we loaded the kids up and headed over there).

Anyway, it worked out. We had a nice lunch at a new place in town (delicious food and great service, btw) and then headed to Point Beach for a swim (it was a good 10° cooler and windy). The boys had a great time. Matthew and I enjoyed lounging about talking and reading. And Katie slept great last night.

Looking good, Keen-Bean!

Looking good, Keen-Bean!

Enoch running along the beach (that really is a happy face).

Enoch running along the beach (that really is a happy face).

Isen running through the water.

Katie is getting tired.

A great day!